this post was submitted on 11 Apr 2024

502 points (100.0% liked)

Memes

1357 readers

35 users here now

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

founded 5 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

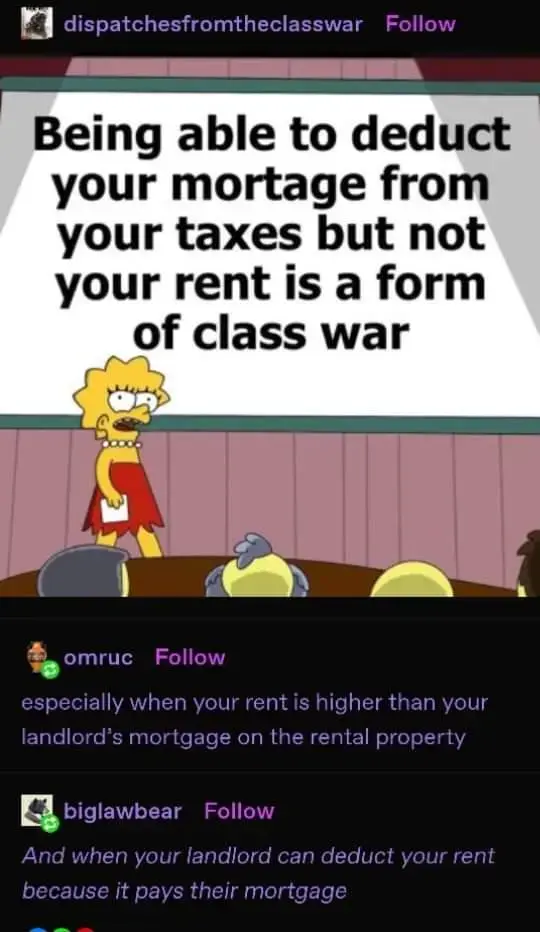

The mortgage tax advantage is just one component of it.

After WWII we made (mostly suburban) homes be retirement investment vehicles for (almost exclusively white) working class people. That was a terrible choice for all future generations of the working class. Now most people (white or not) are priced out. It’s been great for the boomers and the real estate & finance industries, though, thanks to asset price inflation.

From Michael Hudson’s Killing the Host (PDF):